Fixed rate home loans with offset accounts: The perfect pairing

Not many lenders offer an offset account with a fixed rate home loan, however Qantas Money Home Loans does**. Read on to find out why they make the perfect pair.

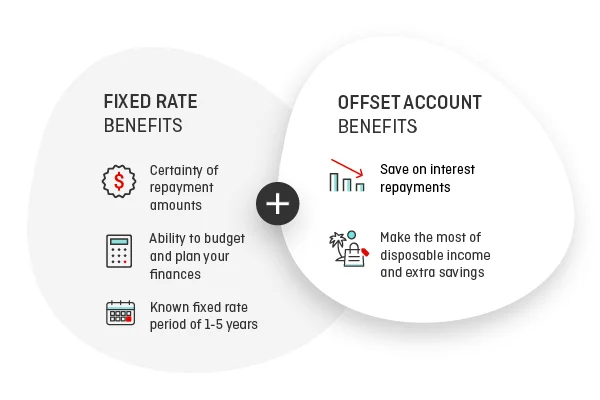

Want the certainty of knowing what your repayments will be but also enjoy the flexibility to save on interest payments? With Qantas Money Home Loans, you can have both with the the option to add an offset account** to your fixed rate loan.

Fixed Rate Home Loans

A fixed rate home loan offers you the security of locking in your home loan rate, which means you won’t need to worry about potential rate rises - something that can happen with a variable rate home loan. A fixed rate also gives you the certainty of fixed repayments, so you know exactly how much you will need to allocate to your home loan over a set period, and can budget accordingly.

One downside to fixed rates though, is that they can limit your additional repayment amount - which means you won’t be able to pay off your loan faster by making extra repayments. So, for example, if your situation changes (like you get a pay rise or come into a little extra money), you won’t get the benefit of being able to pay down more of your principal loan amount to reduce the amount of interest you pay over the life of your loan.

How offset accounts work

An offset account works just like a savings account. However, because it’s linked to your home loan, the balance of money in your offset account is deducted from your home loan balance when your interest is calculated. Which means money held in your offset account over a period of time can reduce the amount of interest charged on your home loan - you could save thousands of dollars in interest over the life of your loan. Also, because the interest rate on an offset account is effectively the same interest rate on your loan, you’ll typically earn higher interest in an offset account than you would with a separate savings account.

You can choose to have your salary deposited into your offset account and set up direct debits - just as you would any other savings account. You can also have a debit card connected to it for everyday purchases. Where it differs from other transaction/savings accounts, is how it’s connected to your home loan. At the end of each day, the balance of your offset account is taken away from the amount you owe on your home loan. The interest for your home loan is then calculated on the difference between them:

Your loan amount - the savings you have in your offset account

Which means if you have money in your offset account, you will pay less interest over the life of the loan and can pay back your home loan faster. It’s a handy way to reduce the amount that your home loan interest is calculated on without having to make extra repayments and needing to redraw them later.

How is an offset account different from a redraw facility?

Offset accounts are different to redraw facilities. An offset account is usually a separate account to your home loan, while a redraw facility allows you to withdraw additional repayments made into your home loan, provided you still have at least one month’s repayment amount remaining in your loan account.

Why an offset account works well with a fixed rate loan

Fixed rates often have a limited amount of additional repayments that can be made, so while you can pay extra into your loan and reduce the interest you pay that way, you are limited with how much extra you can pay into your home loan.

An offset account allows you to add as much money as you want into the account - whenever you want - while also reducing the amount that your interest is calculated on. So you get the best of both worlds, you can have the certainty and stability of a fixed rate, while also gaining the flexibility to pay off your home loan as soon as possible.

With Qantas Money Home Loans, prepayments of the loan principal and use of the Offset Account, are subject to the Points Eligibility Policy.

* You have to be a Qantas Frequent Flyer member to apply for the Qantas Home Loan. This information has been prepared without considering your objectives, financial situation or needs. You should consider your circumstances before acting on this information.

** Offset facility can only be linked to one loan at any one time. Linked offset facility must be in same customer name/number. This is general advice only. Consider PDS and TMD and your personal circumstances before you take out this product.